Digital Asset Market Sees Consecutive AUM Decline and Record-Low Trading Volumes in September 2023

On 27 September 2023, CCData, a renowned FCA-authorized benchmark administrator and global leader in digital asset data, released the September 2023 edition of its highly popular “Digital Asset Management Review” research report. Below are the key highlights from their report.

Franklin Templeton Enters Bitcoin ETF Competition

Franklin Templeton, a financial behemoth overseeing assets worth 1.42 trillion as of May 2023, has thrown its hat into the ring for a Bitcoin Spot Exchange-Traded Fund (ETF). The move comes as the firm seeks to capitalize on the growing interest in digital assets and follows similar initiatives by other traditional asset management companies like BlackRock. Franklin Templeton has chosen Coinbase to act as its primary custodian and will use Cboe BZX Exchange, Inc for its trading activities.

Nomura Introduces Bitcoin Fund Targeted at Institutional Investors

Nomura, Japan’s premier investment bank, is making its foray into the digital asset sector through its subsidiary, Laser Digital Asset Management. The subsidiary has revealed plans to roll out a Bitcoin Adoption Fund designed specifically for institutional investors. The fund aims to offer these investors a direct avenue to invest in Bitcoin, thereby enabling them to benefit from the digital currency’s long-term growth prospects.

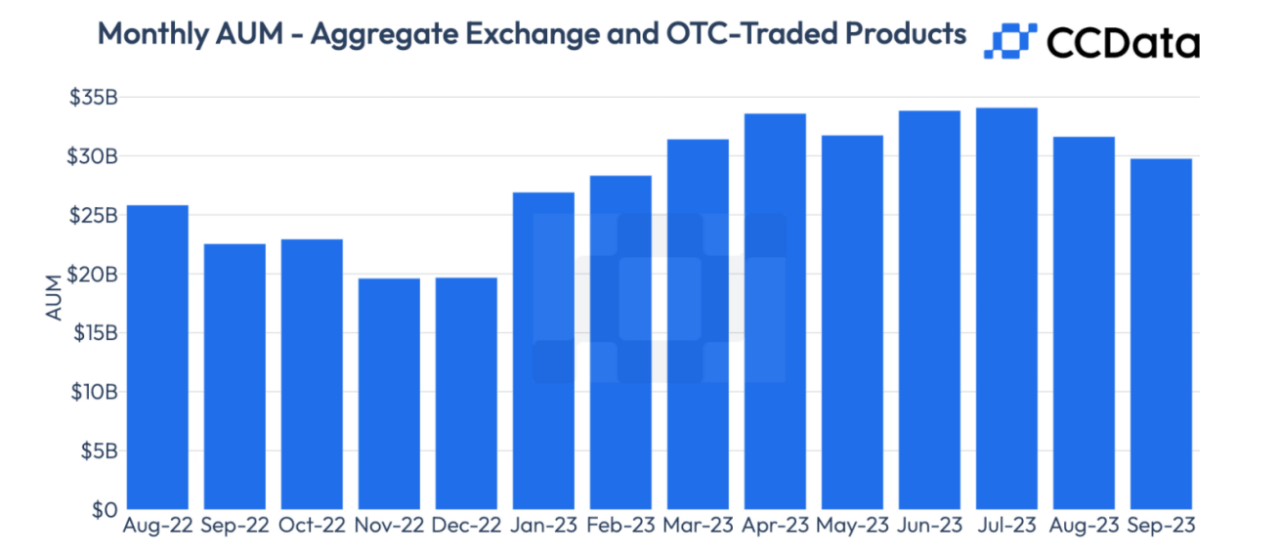

Digital Asset Market Faces Consecutive Monthly Declines in AUM

The digital asset market has not been faring well lately, with Assets Under Management (AUM) experiencing a second straight month of decline. In September 2023, the AUM for digital asset products fell by a notable 5.86%, settling at $29.8 billion. This decline is mainly attributed to the increasing uncertainties in the regulatory landscape, especially the postponements in regulatory verdicts on recent applications.

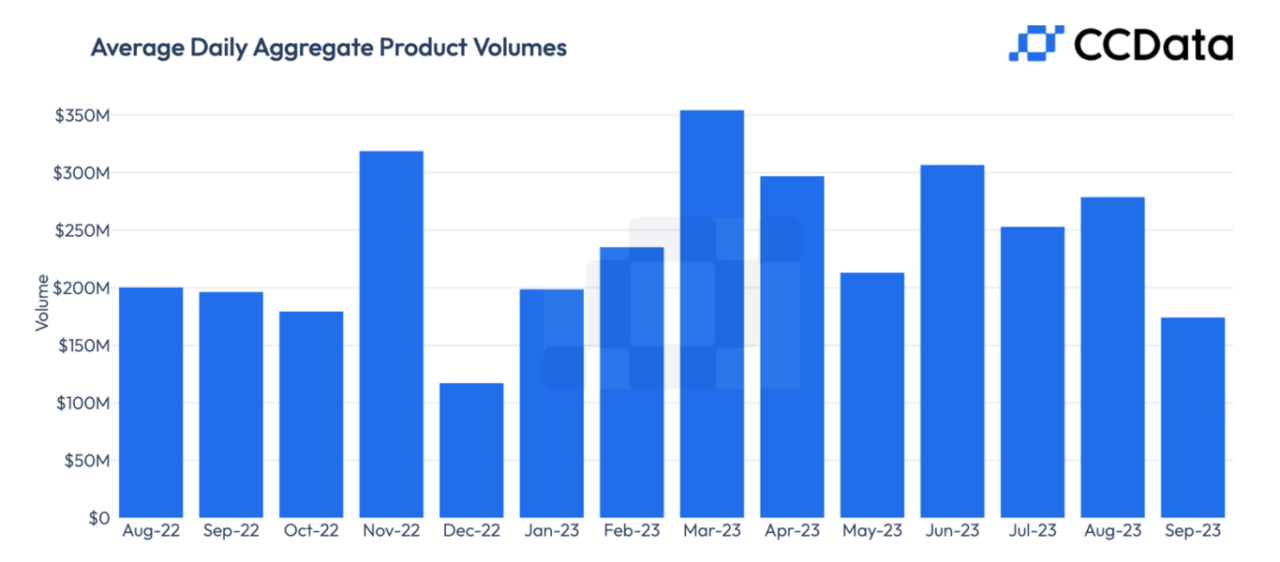

Daily Trading Volumes Hit Lowest Point in 2023

In a similar vein, the average daily trading volumes for digital asset investment products have taken a hit. September 2023 saw these volumes plummet by a staggering 37.6%, amounting to a mere $175 million. This marks the lowest level of daily trading volumes recorded for the year.

Crypto-Linked Stocks Suffer Due to Federal Reserve’s Policies

Stocks associated with digital assets, which had been outperforming Bitcoin in the recent past, faced a sharp downturn in September 2023. This decline is set against the backdrop of the Federal Reserve’s decision to maintain current interest rates while also indicating the likelihood of future rate increases.